The rise in maritime claims throughout 2022 was bad news for insurers, but hardly a surprise as

increased shipping activity following the COVID-19 pandemic led to more incidents onboard. The rising costs of claims also contributed, with inflation pushing up steel prices and creating higher charges for ship spares and labor.

Fire was another factor, according to an Alliance Global Corporate & Specialty report. The research attributed the cause of most blazes to mis-declared or non-declaration of dangerous cargoes onboard containerships. Elsewhere, the increased size of vessels – which have expanded by almost 1,500% in the past 50 years – creating an additional challenge.

The general rule is that bigger vessels lead to increased risks – and bigger losses for both the

insurer and shipowner following an incident. Meanwhile, crewmembers are struggling to deal with

an ever-increasing workload on cargo ships that are significantly bigger than they were several

decades ago, increasing the risk of an incident and potentially contributing to the rising backlog in

claims reporting.

Smaller Marine Insurance Claims Waste Time

Data from the Nordic Association of Marine Insurers shows that the costliest 1% of all claims

account for at least 30% of the value of total claims in any given year. But, surprisingly, it’s the

lower-value, higher-volume claims, worth around US$40,000 on average, that insurers spend most

of their time on. As such, tackling these is key to improving marine insurance companies’

profitability.

The question is, how? Whether faced with potential billion-dollar claims or a deluge of resource-

intensive low-value attritional claims, insurers can use technology to help reduce losses and

improve processes.

Technology is reshaping the mainstream insurance industry and filtering down to specialist segments

within the sector, including marine. Shipping and insurance are undergoing a digital transition, with

leaders in both markets recognizing that data-driven insights hold the key to significantly de-risking

operations, driving efficiencies and mutually boosting commercial performance.

Reducing the Risk of Incidents Using AI-powered Insights

Establishing why a navigational incident happened is often difficult because many ships have

limited contact with shoreside teams once they leave port. With limited visibility into ship

operations, it’s impossible to know what occurred on board when a vessel is involved in a major

incident such as a fire, piracy attack, or sinking.

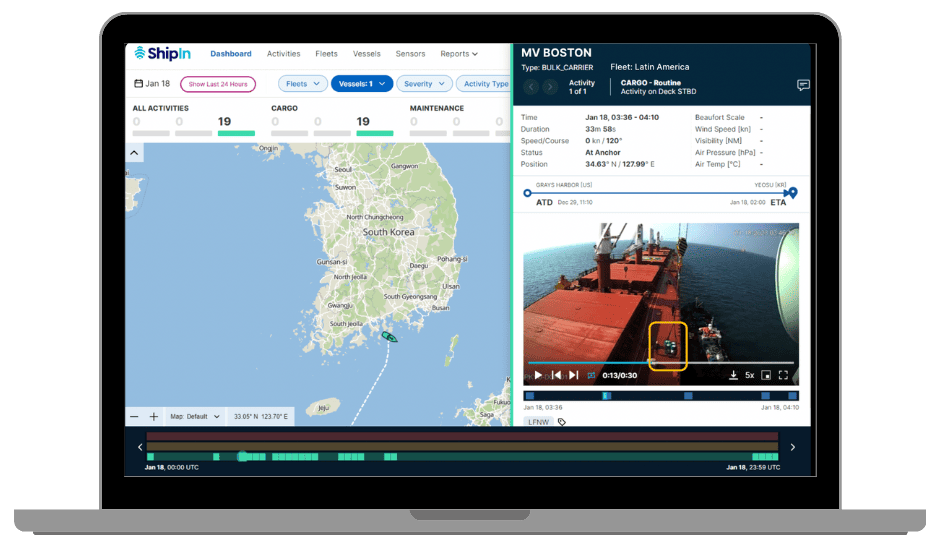

By using an AI-powered platform that plugs into a vessel’s CCTV, footage of such incidents can be

retrieved in near real-time to identify the cause, negating the reliance on witness testimonies. The

quality and visual aspect of this evidence allows insurers to close claims faster, and to challenge

the validity of claims. This, in turn, reduces the time and the costs associated with a claim including

the input of loss adjusters and lawyers.

Unlike traditional maritime CCTV, an AI-powered analytics system like our FleetVision™ platform

provides immediate, real-time visual data. It creates intelligence that teams can use immediately to

shape safety protocols and onboard behavior. This also eradicates the need to sift through 10,000 hours of footage for every vessel each month to determine retroactively what happened on board following an incident.

AI-powered maritime CCTV also supports loss prevention by identifying any potential maintenance or safety risks related to piloting, security, and cargo handling. It monitors onboard operations, alerting the crew and shoreside fleet managers to issues that require attention.

Sharing data insights is a win-win for insurers, brokers, and ship owners, but it requires a level of

transparency that is still uncomfortable for many. To really tap the advantages, ship operators and

their crew need to build their confidence in the merits of sharing ‘warts and all’ evidence. In

response, insurers should support this by rewarding companies that take such measures to

prevent losses and incidents. Doing so has the potential to create symbiotic benefits that contribute to broad improvements in efficiency, profitability, and a safer seafaring culture.